Freelance invoice templates for small businesses in the UK need to be professional and customizable while meeting the unique needs of each business, and helping you charge appropriate VAT. Freelancers spend much of their time in the shop, office or jobsite working for their clients and customers. That leaves less time for invoicing, billing and collecting payments. Freelancers in the United Kingdom need to be able to quickly create invoices for their customers, so they can spend more time serving clients and customers. English and UK freelancers require freelance invoice templates that are designed to include both the project or job costs billed to customers and VAT. And the freelance invoice templates need to support a range of payment methods for simple, fast billing.

The Best UK Freelance Invoice Templates in 2023

Our favorite templates

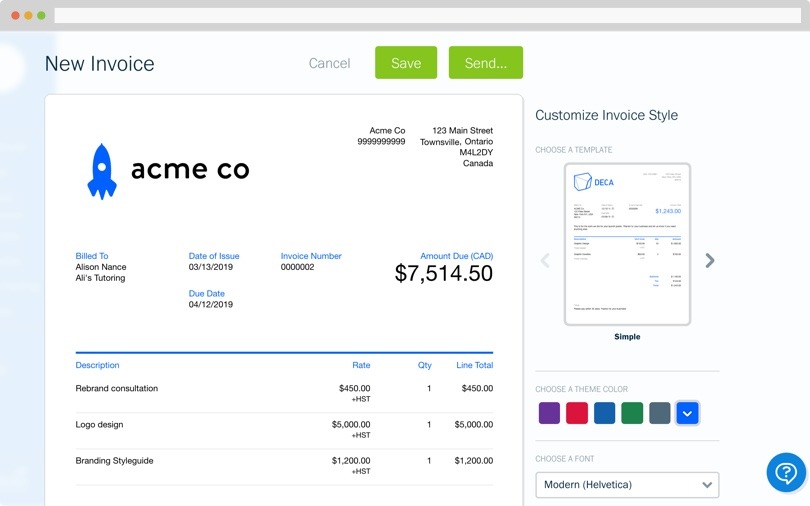

Freshbooks UK Freelance Invoice Template

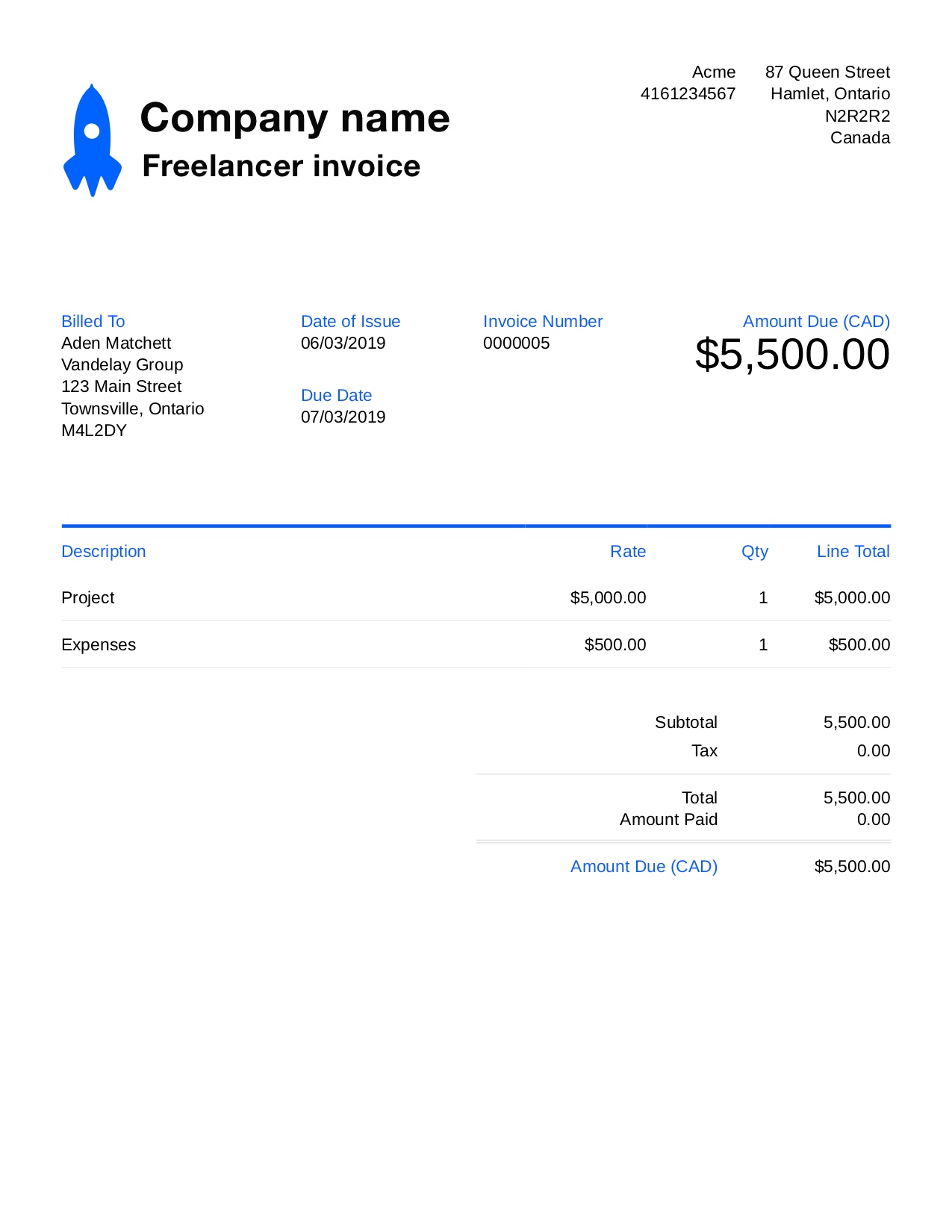

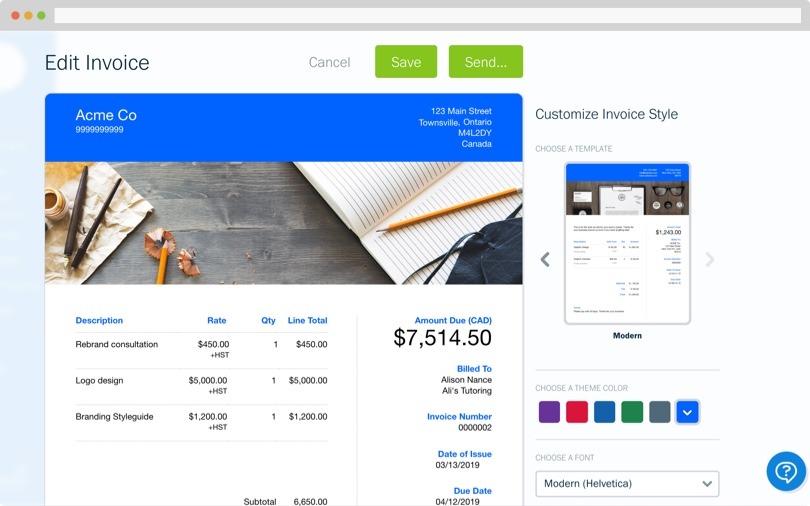

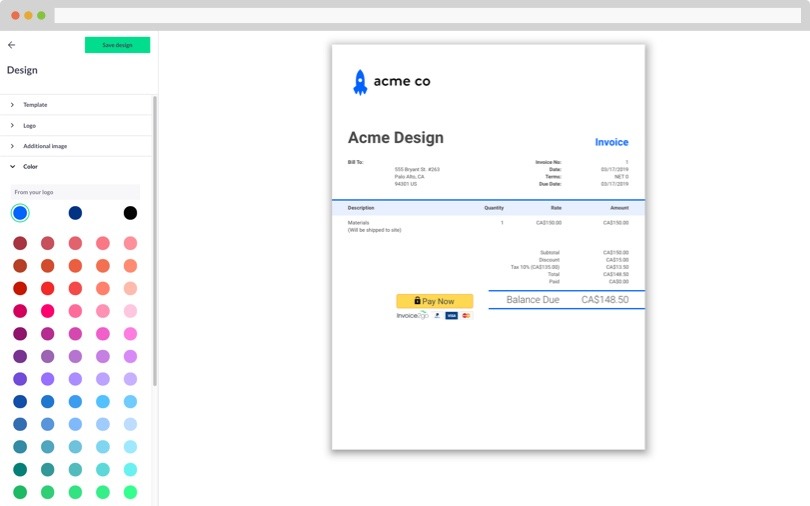

Customize Invoices

Choose from a selection of invoice templates to find a design that meets the needs of your unique business in the UK. Upload your logo and use your company’s fonts and color scheme for a simple but sleek invoicing solution.

Get this template

Professional Invoice Design

Choose from professionally designed freelance invoice templates for businesses located in the UK that are easy to use and customize.

Get this template

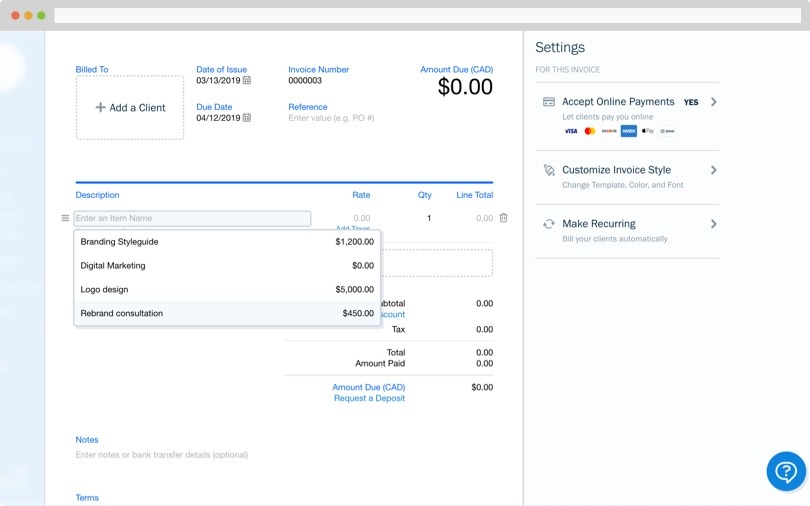

Easy to use

Create professional invoices in minutes. Use simple accounting tools to manage your business finances including VAT in your native currency (GB£ sterling).

Get this template

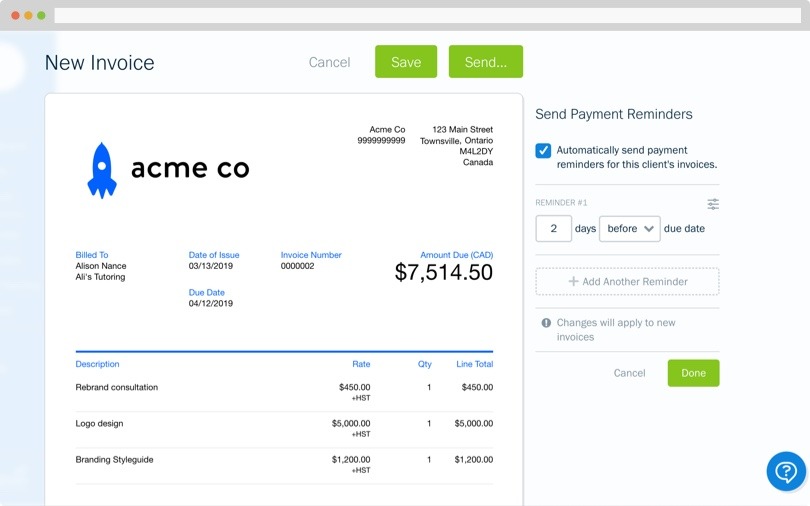

Automatically Charge Late Fees and Send Payment Reminders

Enable automatic payment reminders according to a set schedule. Automatically charge late fees using a flat-fee structure or a percentage charge.

Get this template

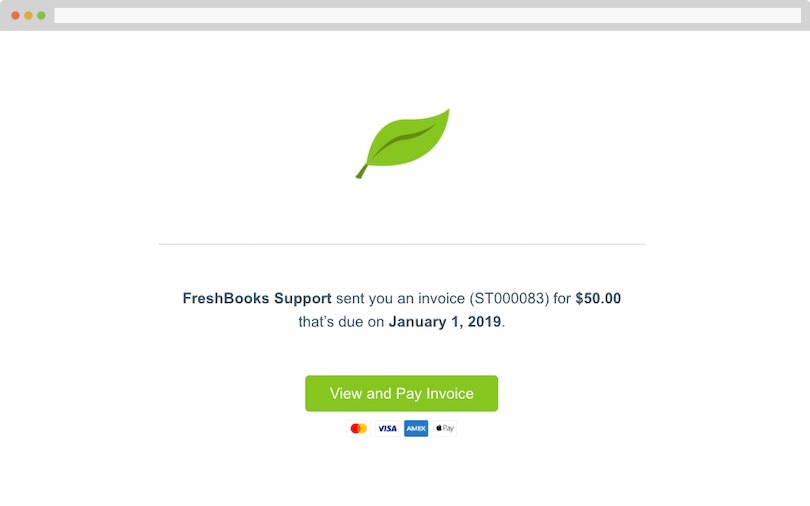

Client Can View Invoices Online

Clients in the UK and beyond can view an invoice online and make payments directly from the invoice.

Get this template

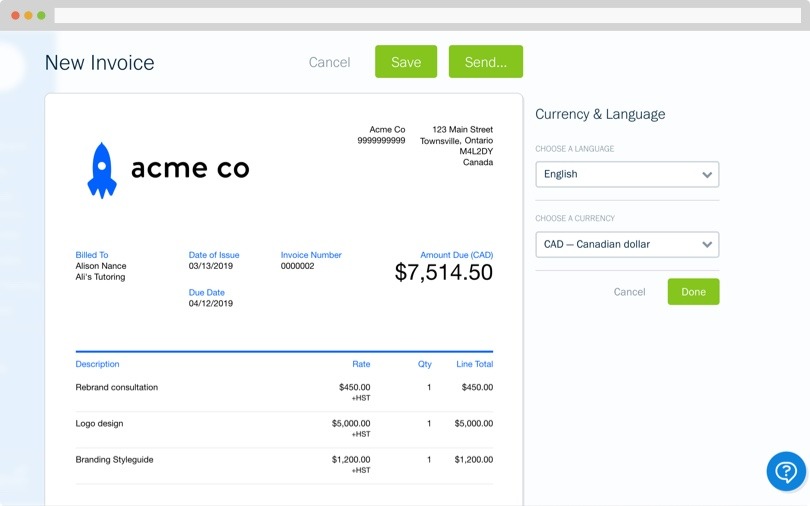

Adjust Invoice Language and Currency

Select a preferred language and currency, whether GB£ sterling or another currency while editing a new invoice.

Get this template

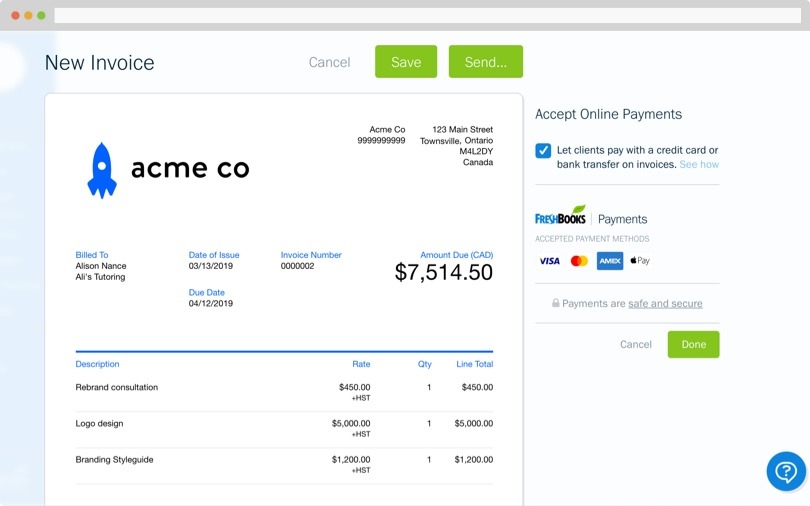

Accept Online Payments

Accept online payments through FreshBooks so clients can pay directly online with a credit card.

Get this template

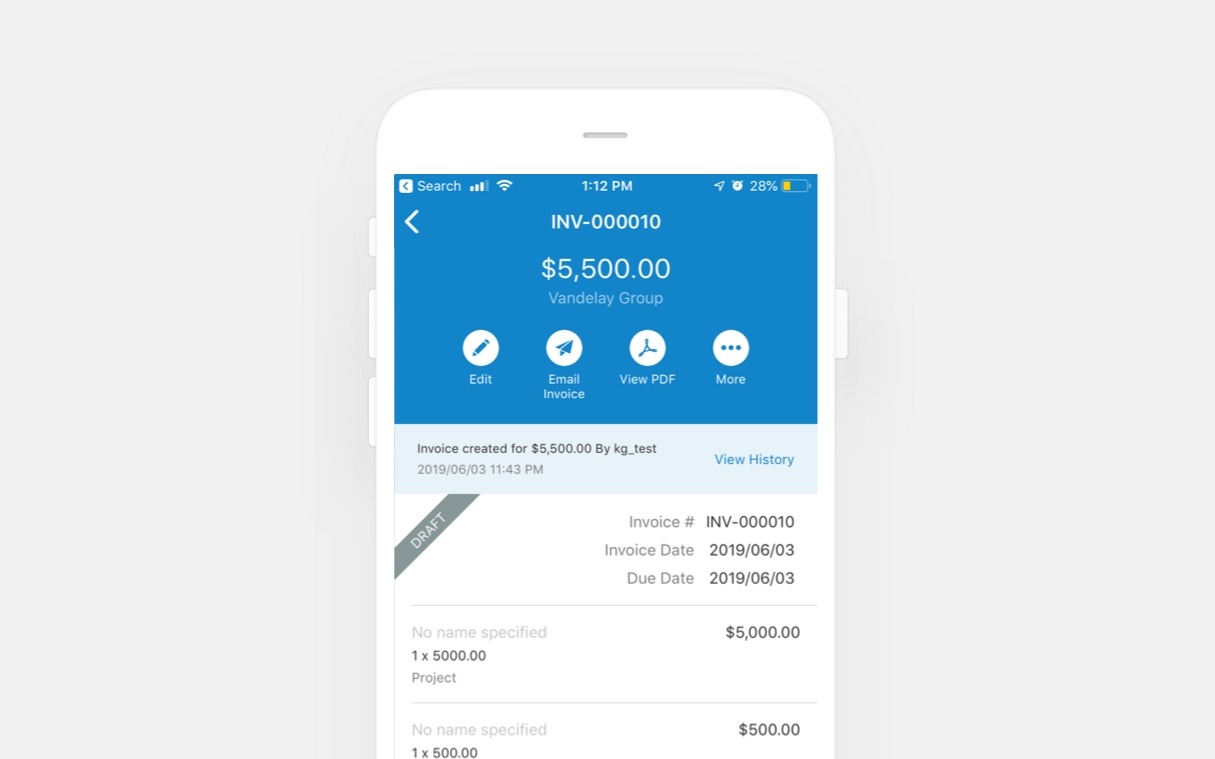

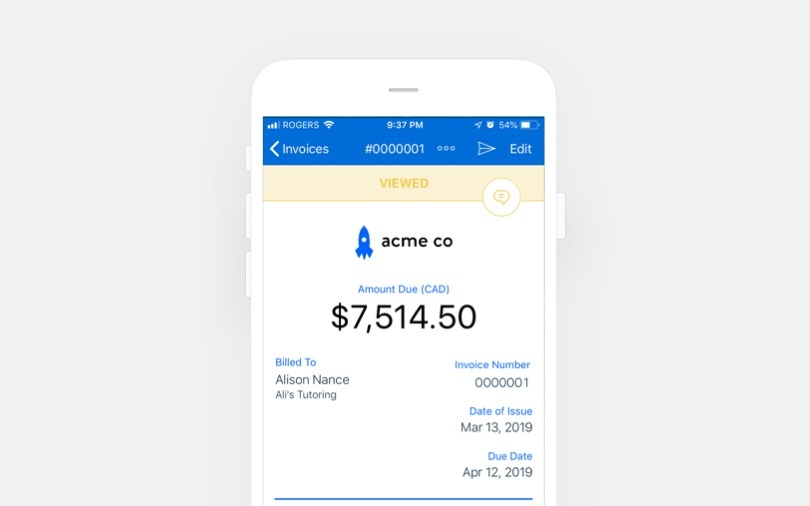

Mobile Friendly

Create invoices and manage business finances from anywhere with the FreshBooks mobile app.

Get this templateBest UK Freelance Invoice Templates Compared

Get the best invoicing software to grow your UK business. We tested the top invoice solutions of 2023 for business in the UK and analysed their offerings across the key invoicing features freelancers in the UK (England, Scotland, Wales and Northern Ireland) need. Here’s how they compare:

Customize Invoice |  |  |  |  |  |

Draft Invoices |  |  |  |  | |

Professional Invoice Design |  |  |  |  |  |

Accountant Friendly |  |  |  |  |  |

Easy To Use |  |  |  |  |  |

Automatic Late Fees and Payment Reminders |  | Automatic Reminders, No Automatic Late Fees |  | Automatic Late Fees Available on Some Plans; Payment Reminders Must Be Sent Manually | Automatic Late Fees, Reminders not Automated |

Track Invoice Payments |  |  |  |  |  |

Client Can View Invoice Online |  |  |  |  |  |

Change Invoice Language and Currency |  |  |  |  |  |

Accept Online Payments |  |  |  |  |  |

Download as PDF |  |  |  |  |  |

Mobile Friendly |  |  |  |  |  |

The Best UK Freelance Invoice Templates: Reviews

We reviewed the top invoice templates for freelancers in the UK to give our in-depth assessment of how their features serve British and Northern Irish freelancers. Our reviews give insights into the invoicing and accounting capabilities of the top invoicing solutions available. See how they stack up across functionality, design and ease of use.

Invoice2go UK Freelance Invoice Template

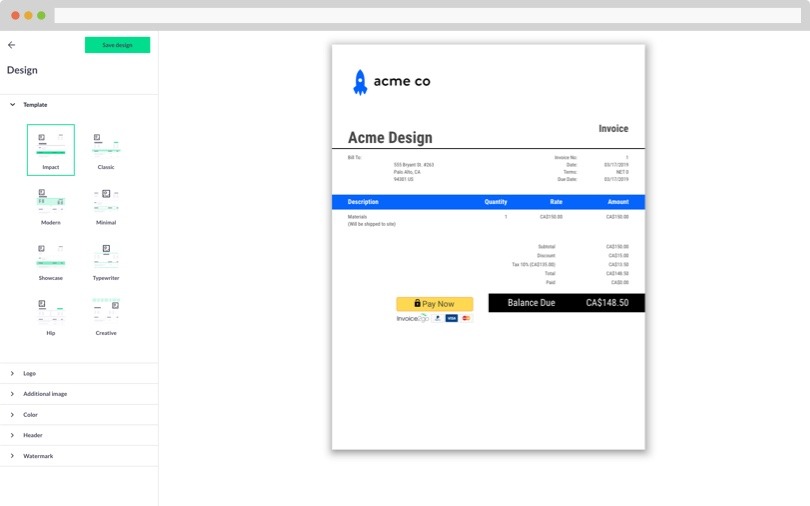

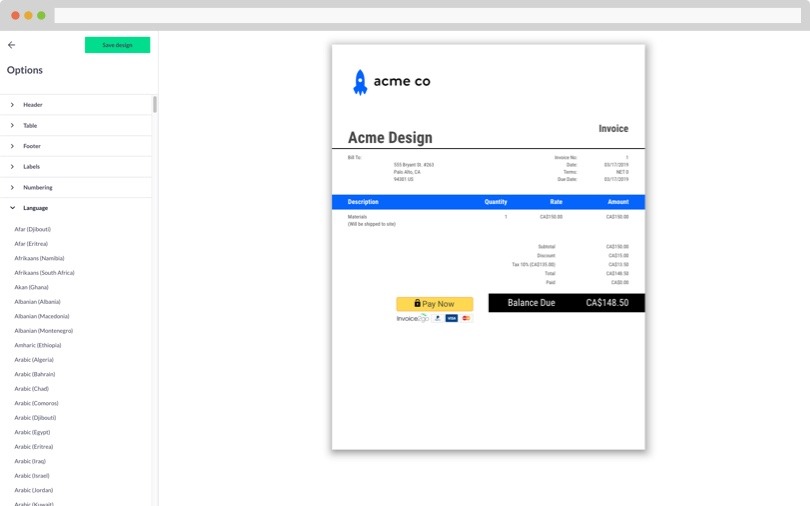

Customize Invoices

Create customized invoices by selecting from a range of freelance invoice templates. Adjust the layout and design to suit your freelance needs.

Get this template

Professional Invoice Design

Select a professional invoice from 8 template designs and add your business’s color scheme, logo and fonts.

Get this template

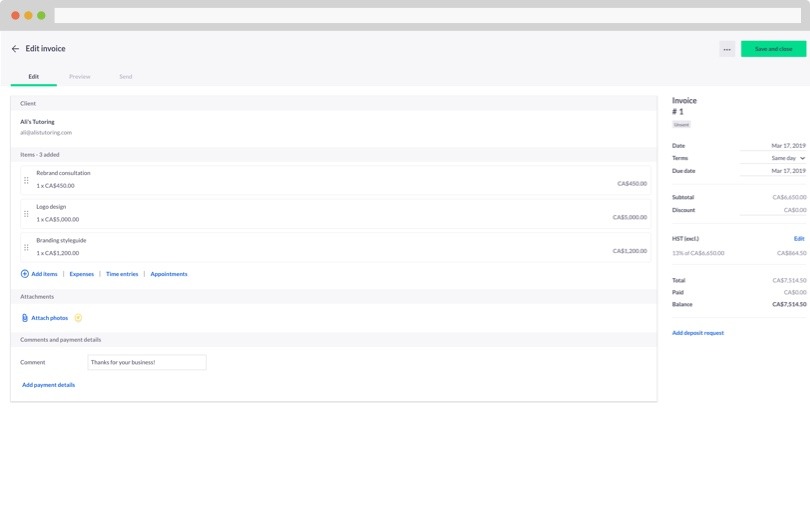

Easy to Use

Invoice2go’s simple interface makes it easy to get up and running hassle free

Get this template

Automatically Send Payment Reminders

Send late payment reminders to clients automatically by creating a late payment reminder schedule.

Get this template

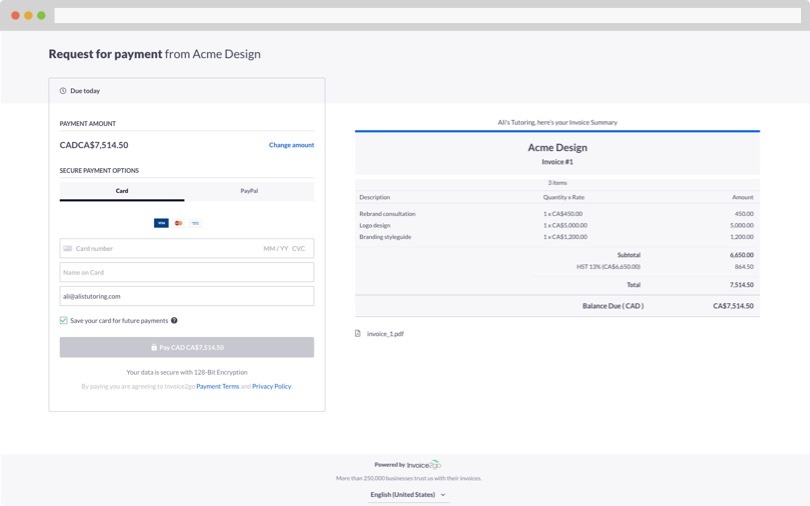

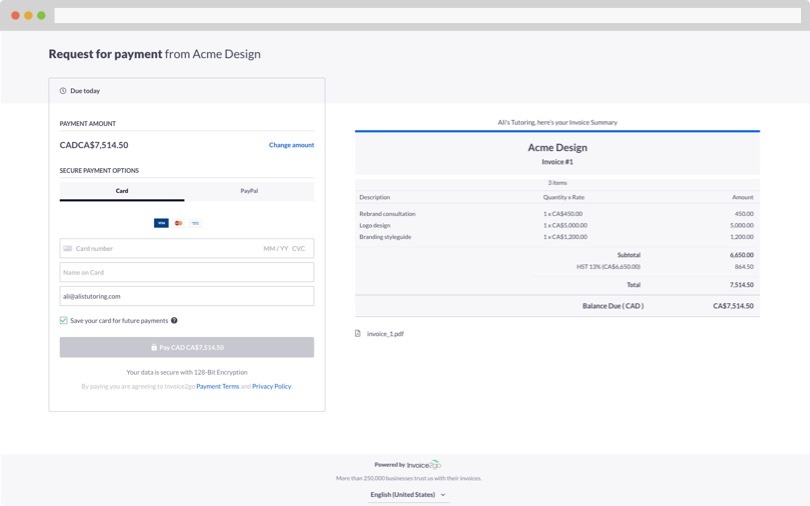

Client Can View Invoices Online

Clients can click to view invoices online and review their payment deadlines and history.

Get this template

Adjust Invoice Language and Currency

Adjust invoice currency by editing the client’s profile. Change the invoice language by editing the invoice template.

Get this template

Accept Online Payments

Link your bank to your Invoice2Go account to accept debit and credit card payments online. Option to pass on card processing fees to clients.

Get this template

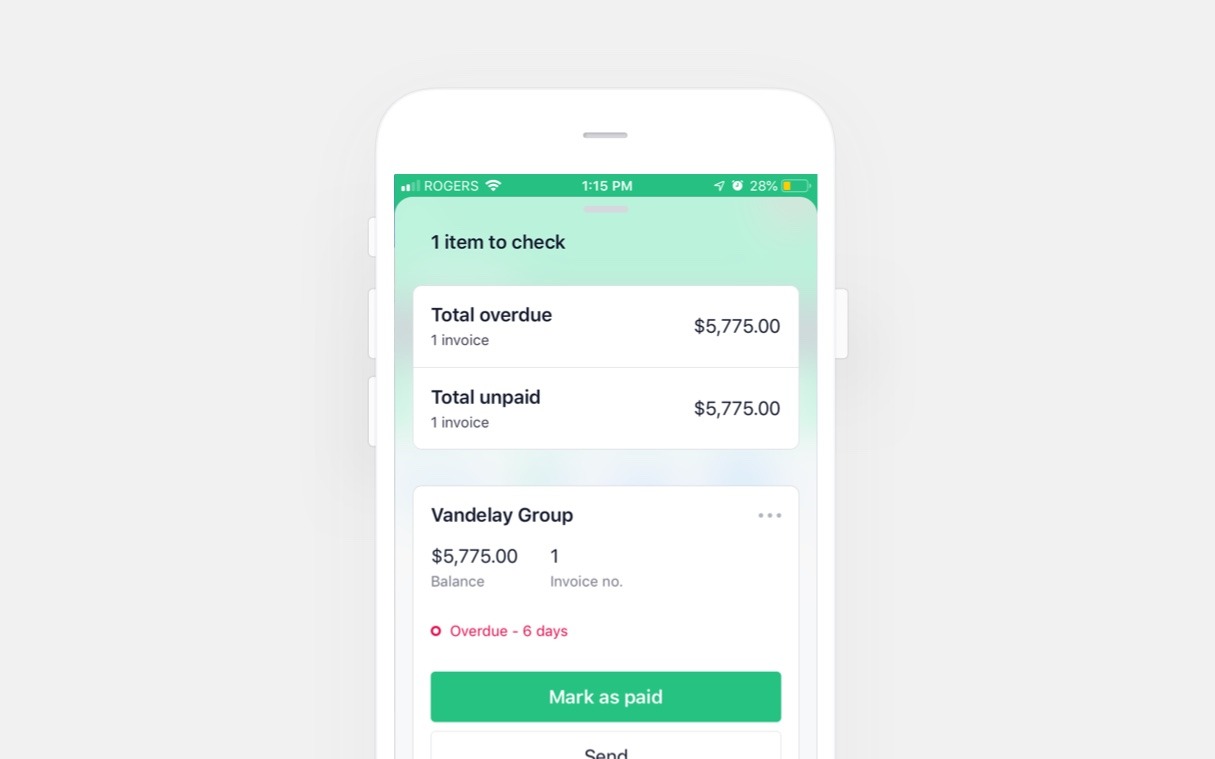

Mobile Friendly

Download the Invoice2Go app to manage your business finances and create invoices from anywhere.

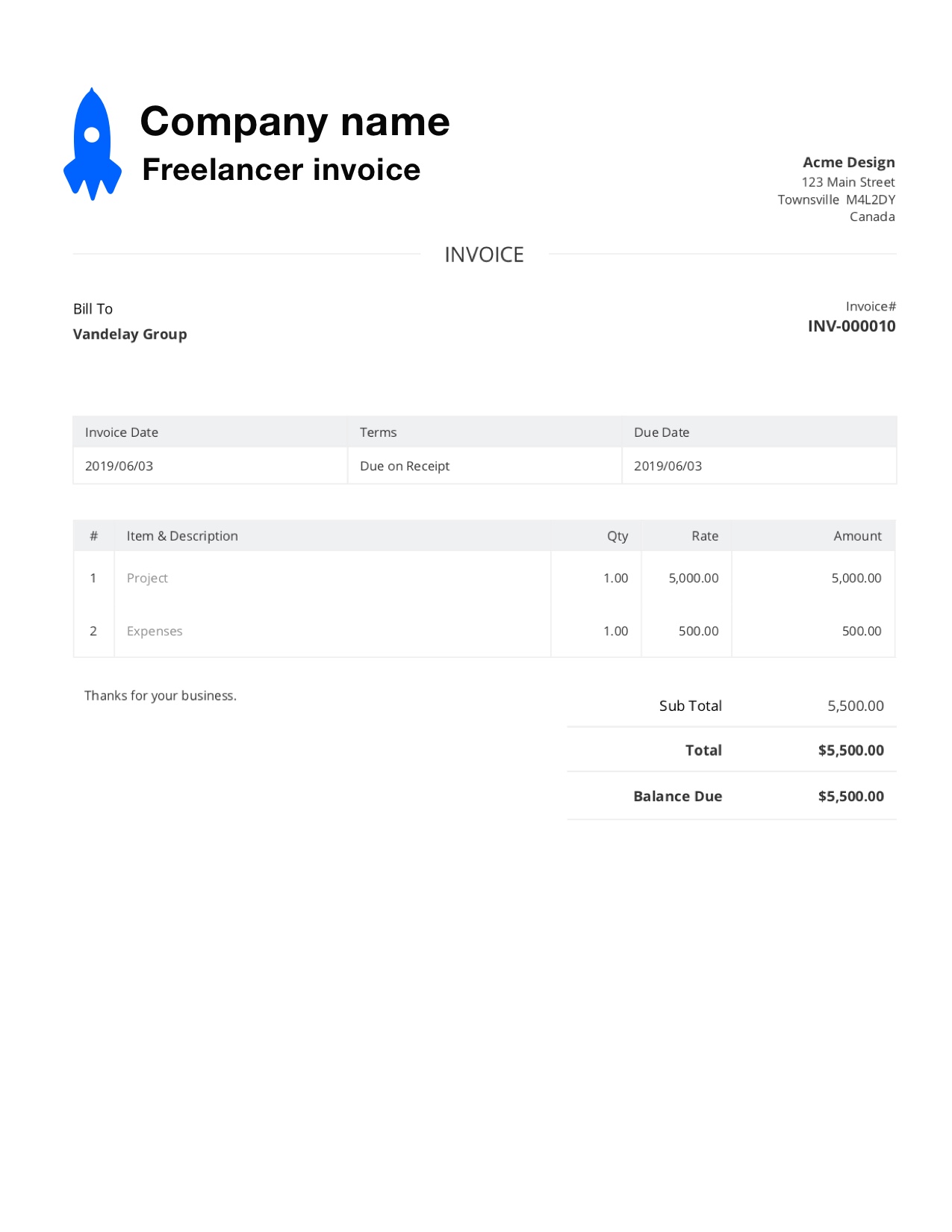

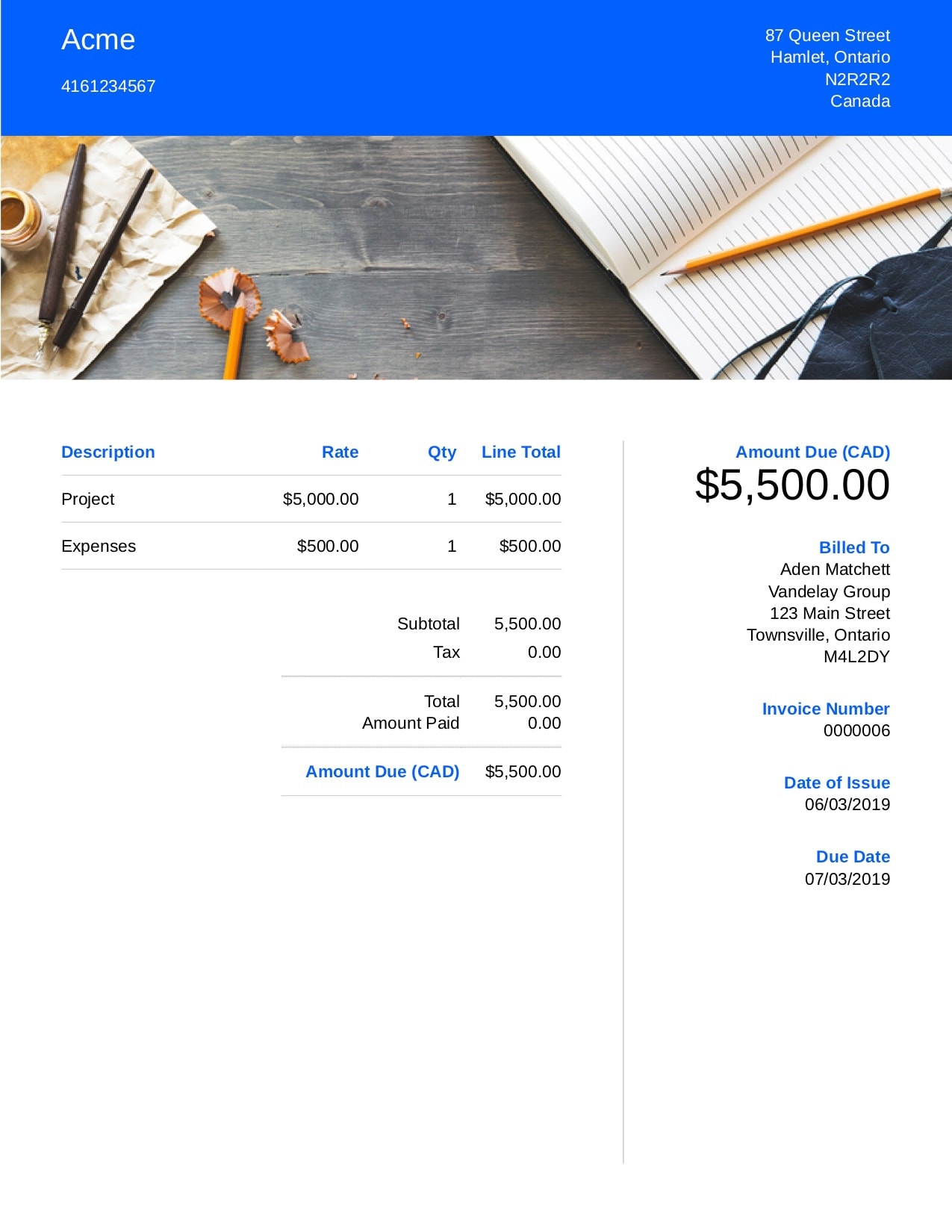

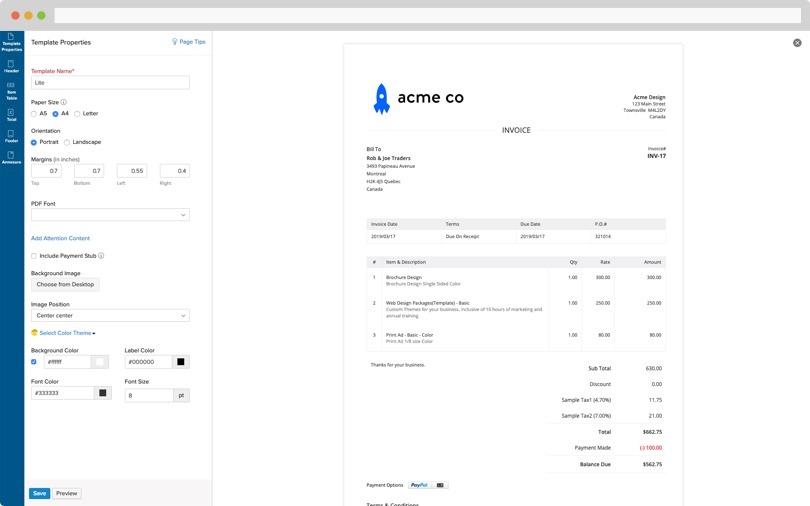

Get this templateInvoice Ninja UK Freelance Invoice Template

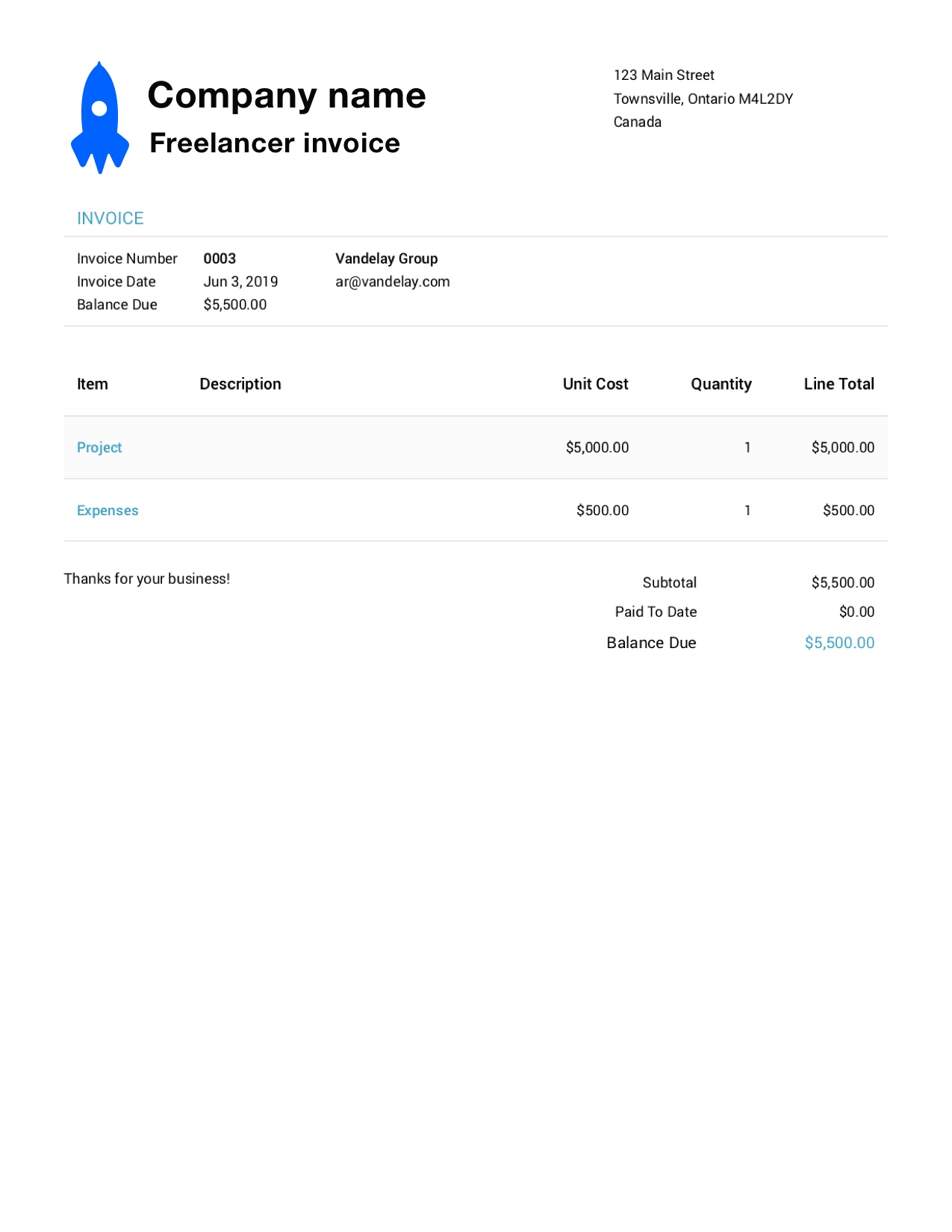

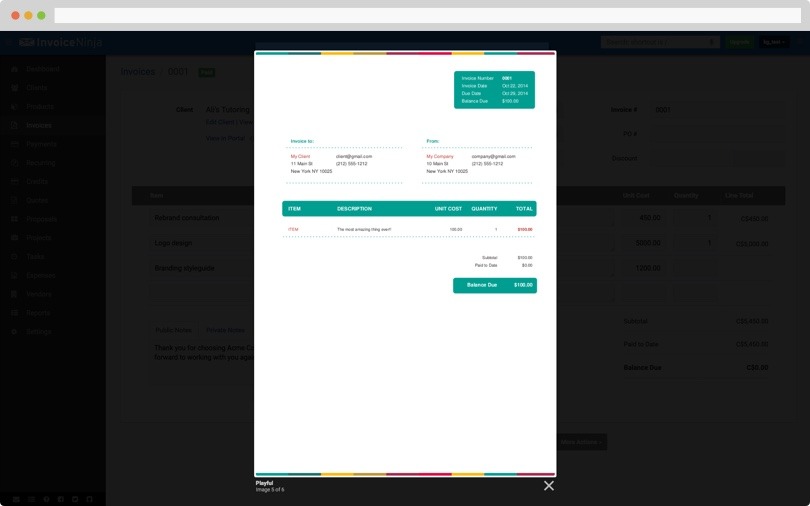

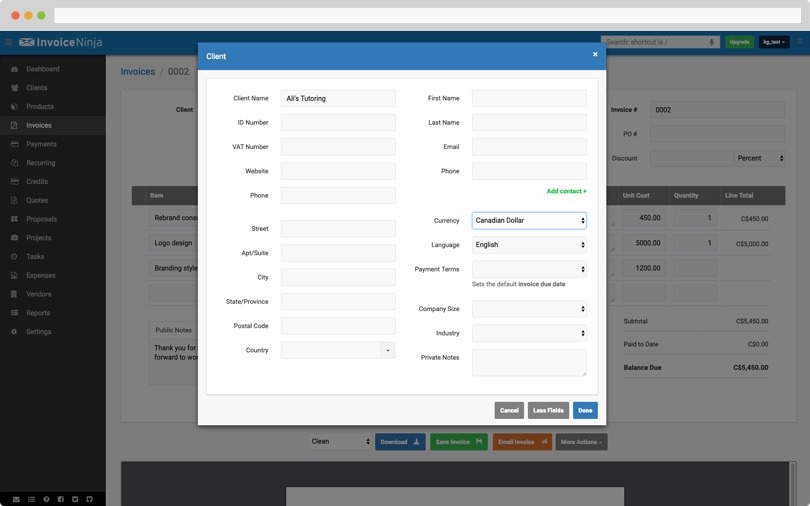

Customize Invoices

Create custom invoices from a range of invoice design templates. Add your business logo and adjust the color scheme, fonts and layout.

Get this template

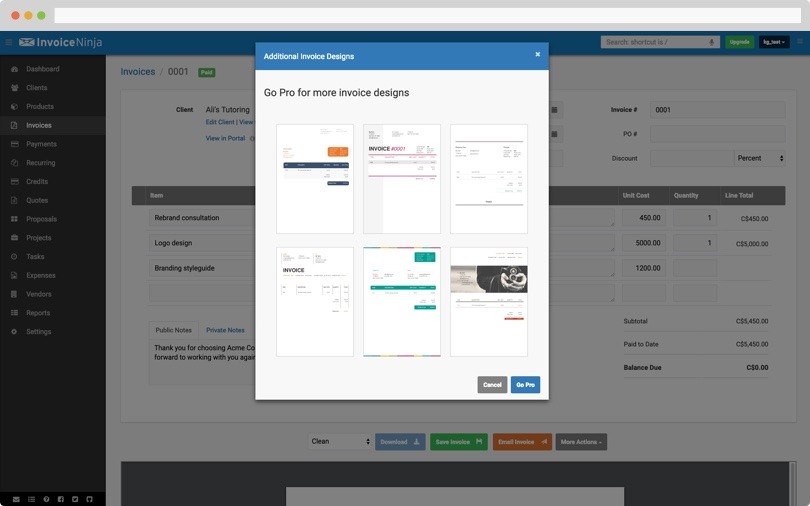

Professional Invoice Design

Select your preferred template from a range of professional invoice designs for customized billing.

Get this template

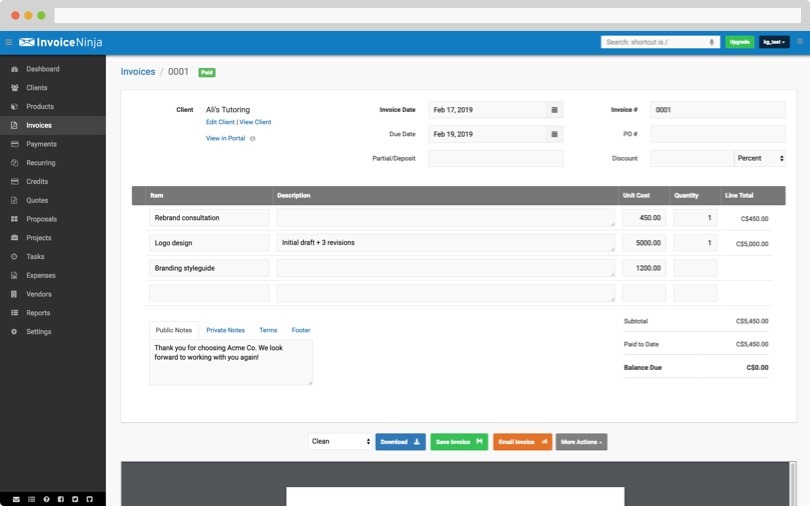

Easy to use

Easily create custom invoices in minutes by selecting from a range of invoice templates and plugging in your client’s information

Get this template

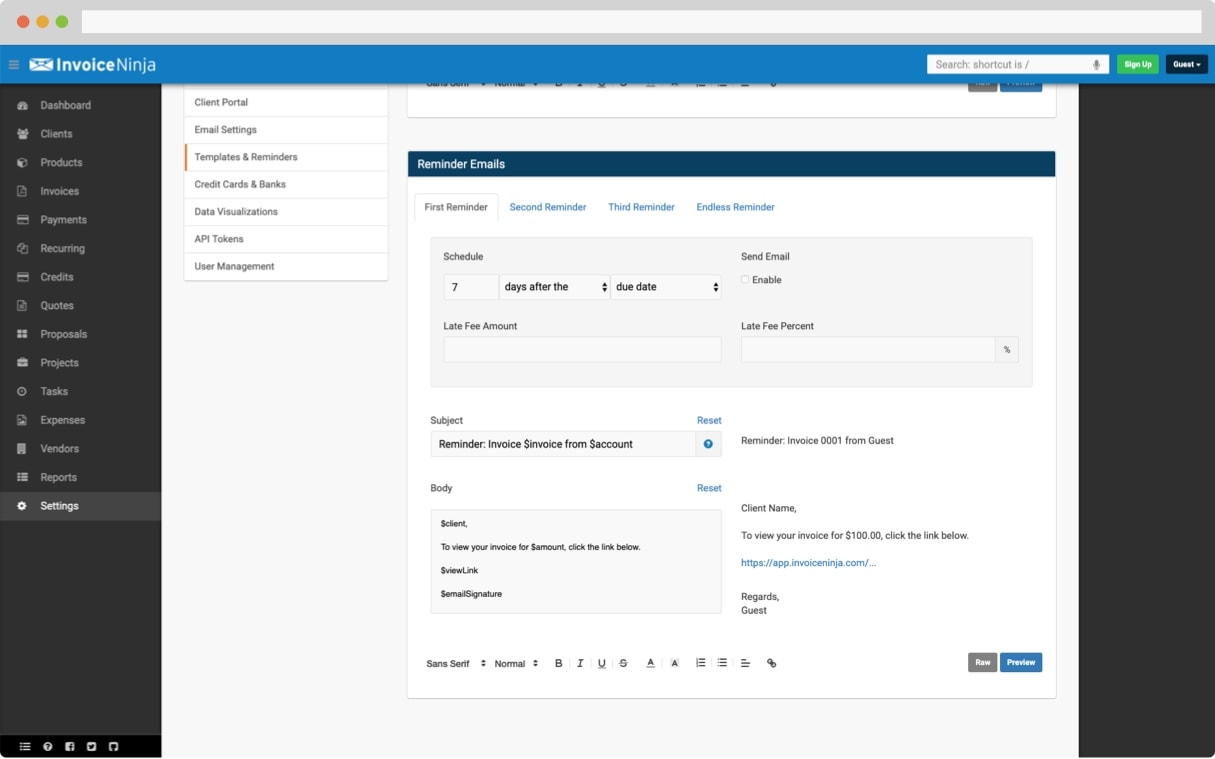

Automatically Charge Late Fees and Send Late Payment Reminders

Send automatic late payment reminders using email notification templates. Charge late fees to clients by percentage or a set fee.

Get this template

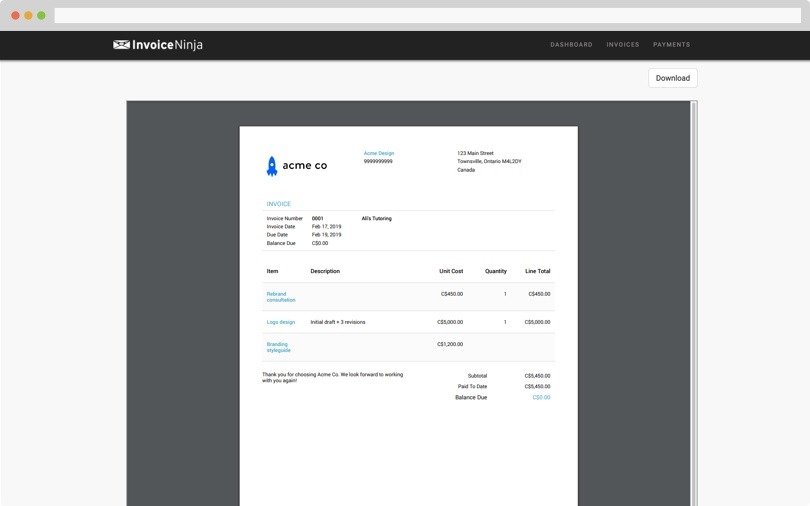

Client Can View Invoices Online

Clients can view and pay invoices online using the client portal. Customize the portal for your business and opt to add password protection for further security.

Get this template

Adjust Invoice Language and Currency

Edit client profiles to customize language and currency preferences, for GB£ sterling or other currencies

Get this template

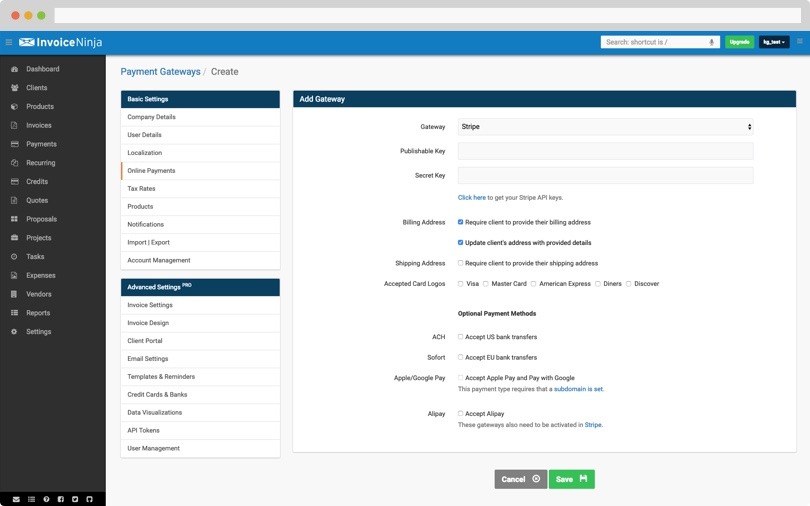

Accept Online Payments

Accept online payments by choosing a payment gateway from a range of providers including PayPal, Stripe and Square.

Get this template

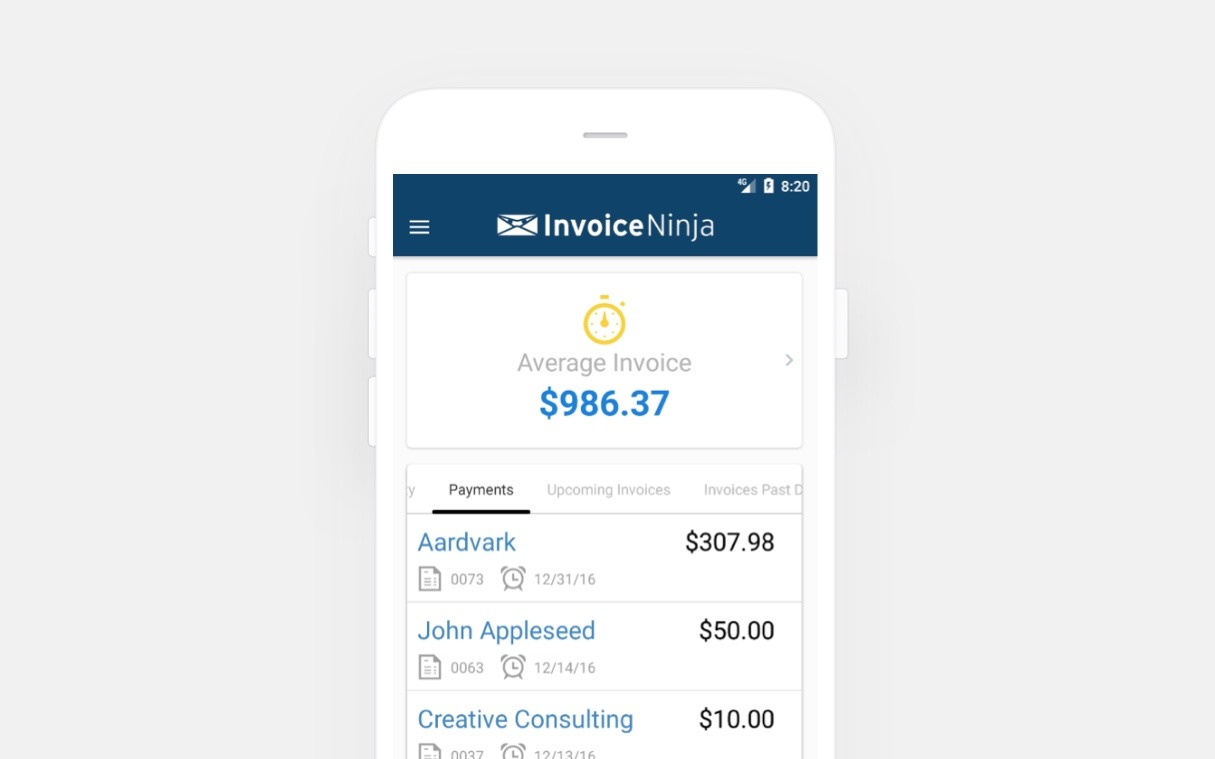

Mobile Friendly

Create and send invoices from the shop, jobsite or your home office with the Invoice Ninja app.

Get this templateQuickbooks UK Freelance Invoice Template

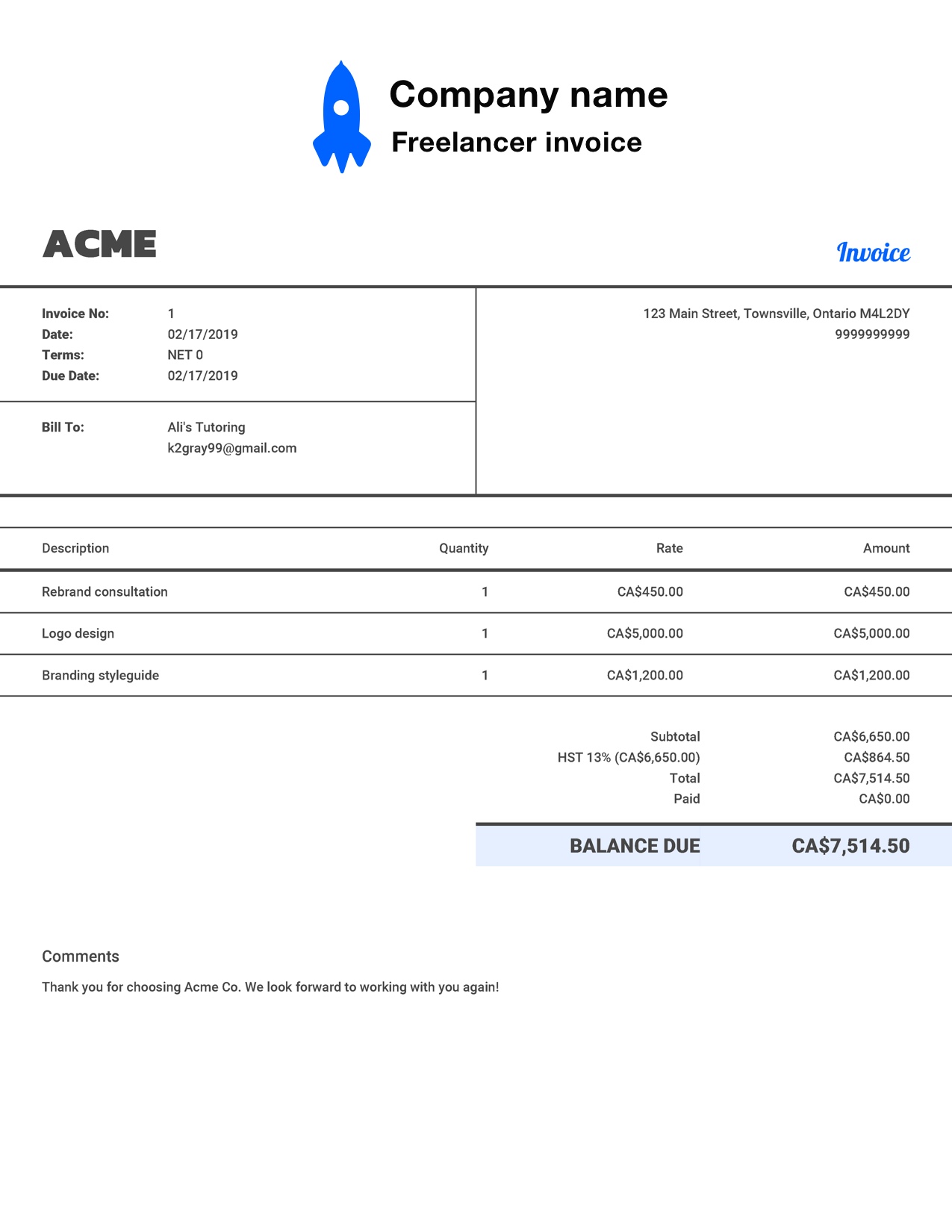

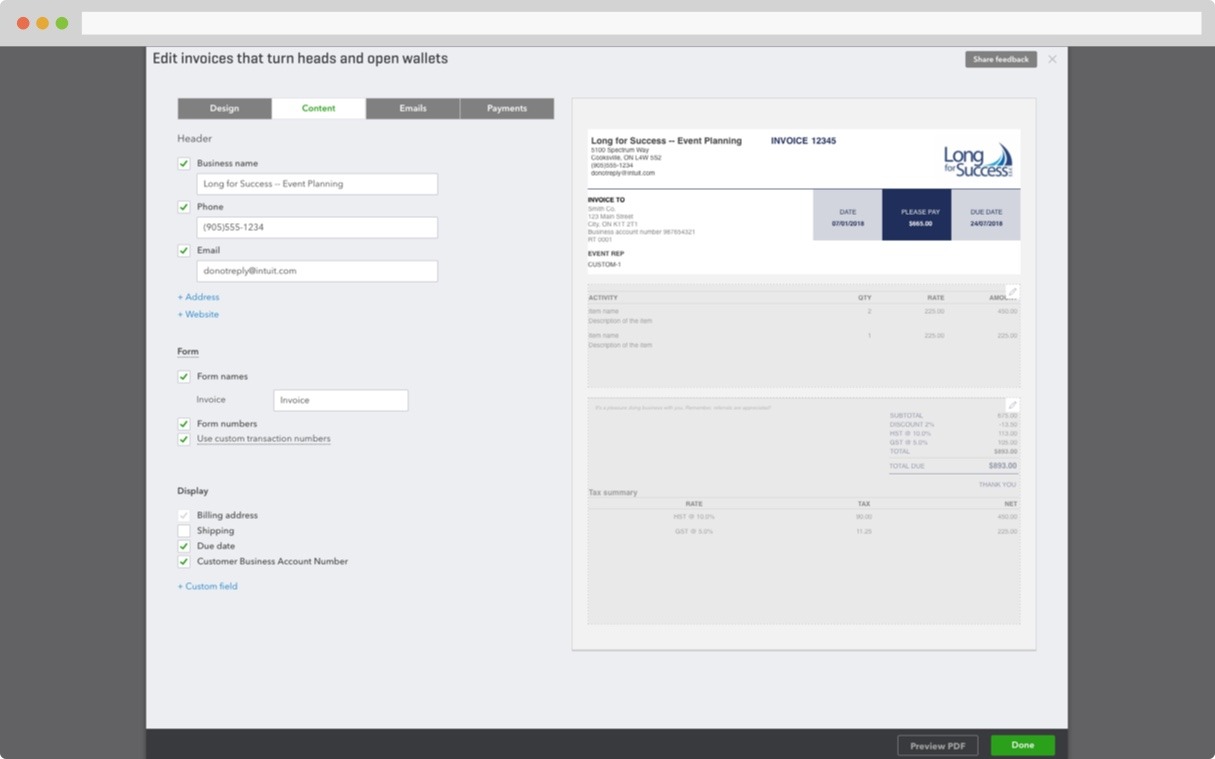

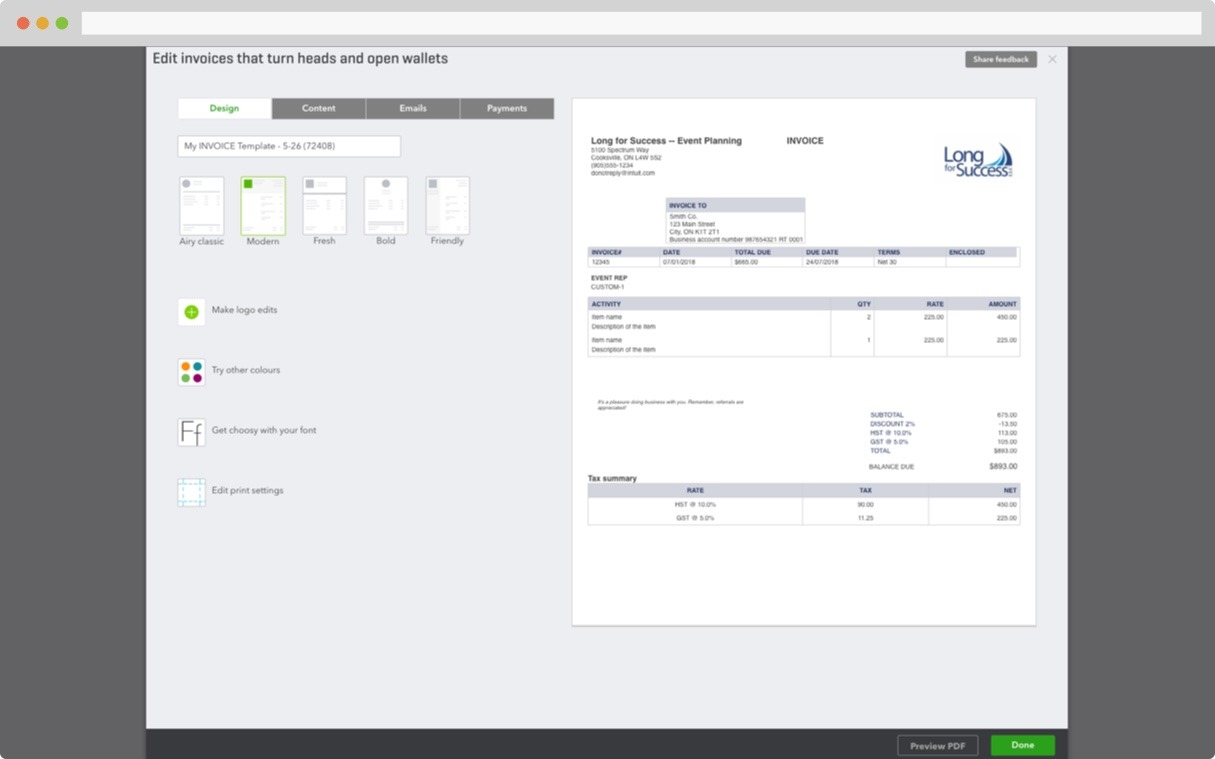

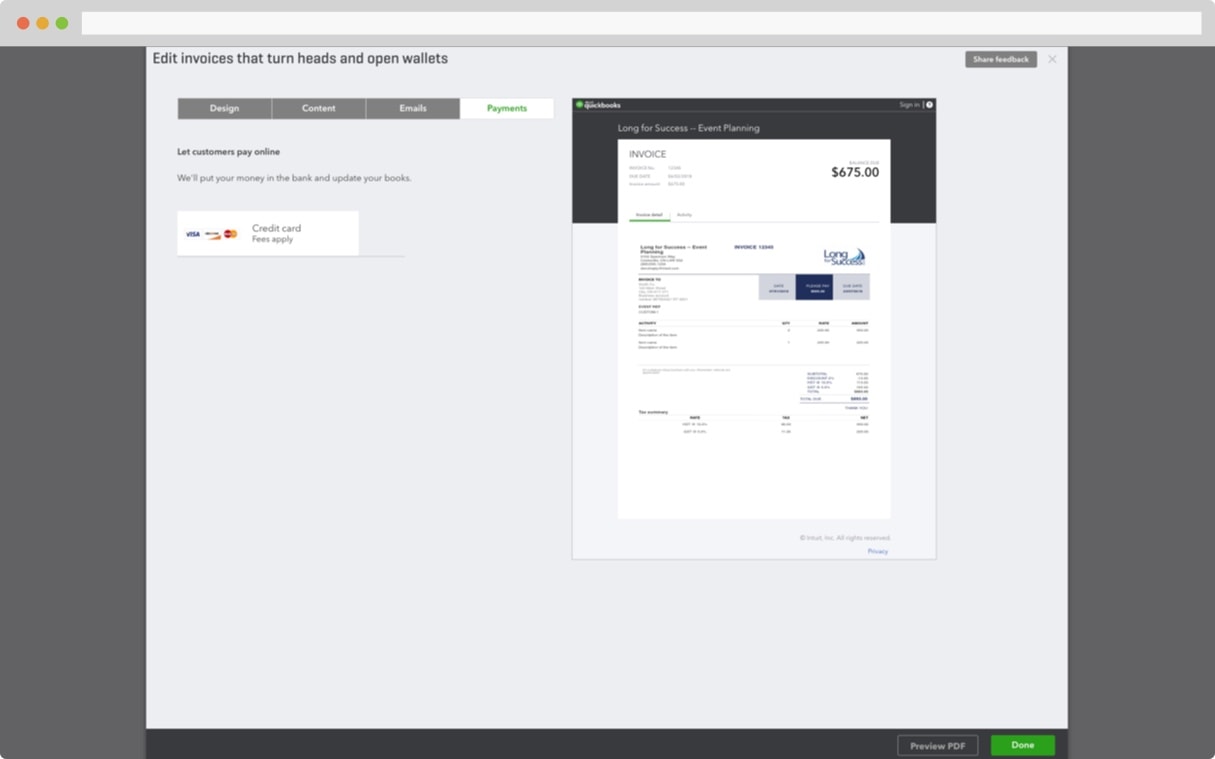

Customize Invoices

Create custom invoices for your freelance business using a range of invoice template designs that can be altered to reflect your personal brand.

Get this template

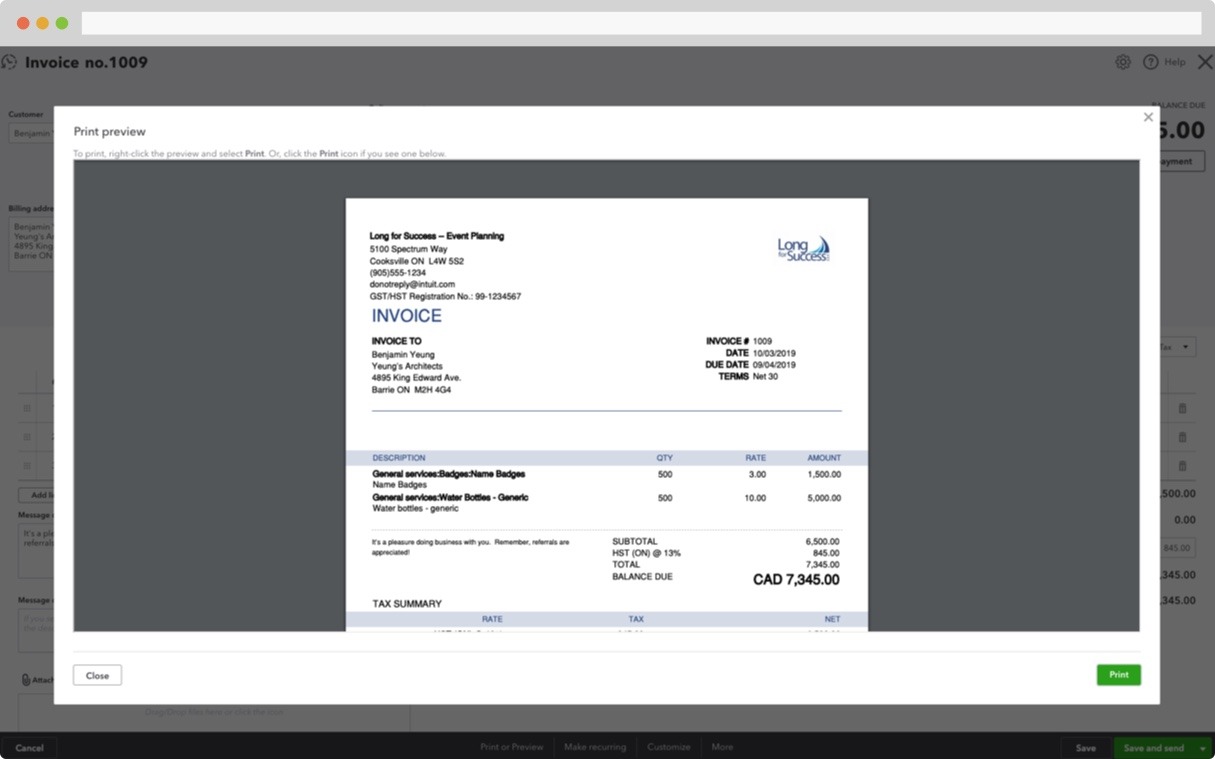

Professional Invoice Design

Choose a freelance invoice template from five professional designs. Further customize your template to include the details that your business requires, like material costs.

Get this template

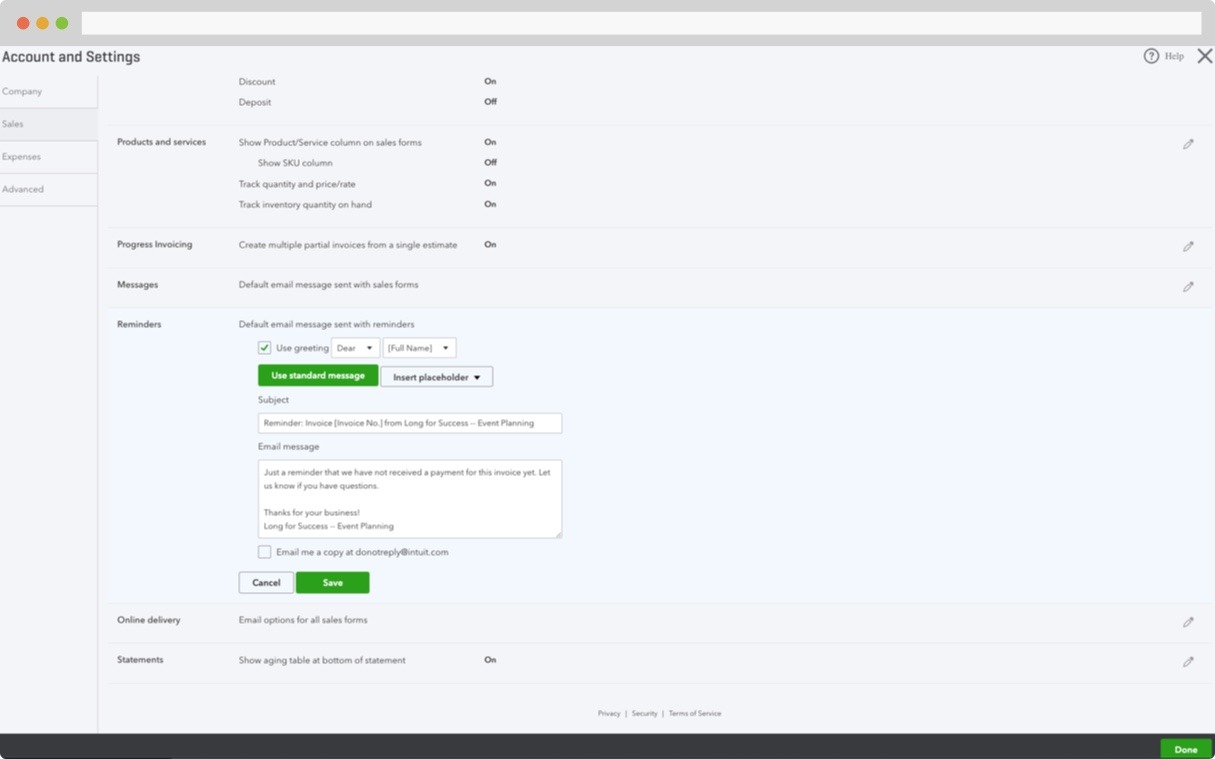

Automatically Charge Late Fees and Send Payment Reminders

Only select QuickBooks users can automatically charge late fees on invoices, but the feature should be rolled out for all users in the future. Use professional email reminder templates to manually send payment reminders to customers.

Get this template

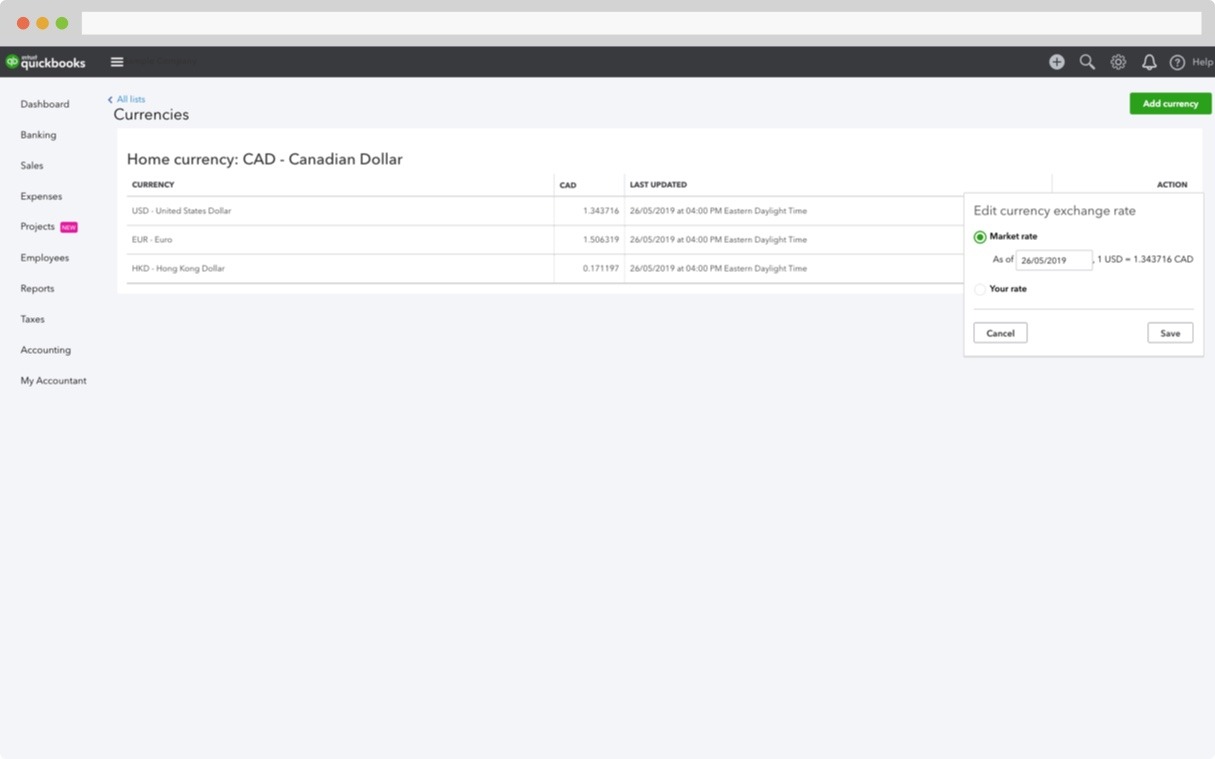

Adjust Invoice Language and Currency

Not only invoicing in GB£ sterling? It’s easy to change the currency and language settings within Account Settings.

Get this template

Accept Online Payments

Accept online payments directly from your QuickBooks account.

Get this template

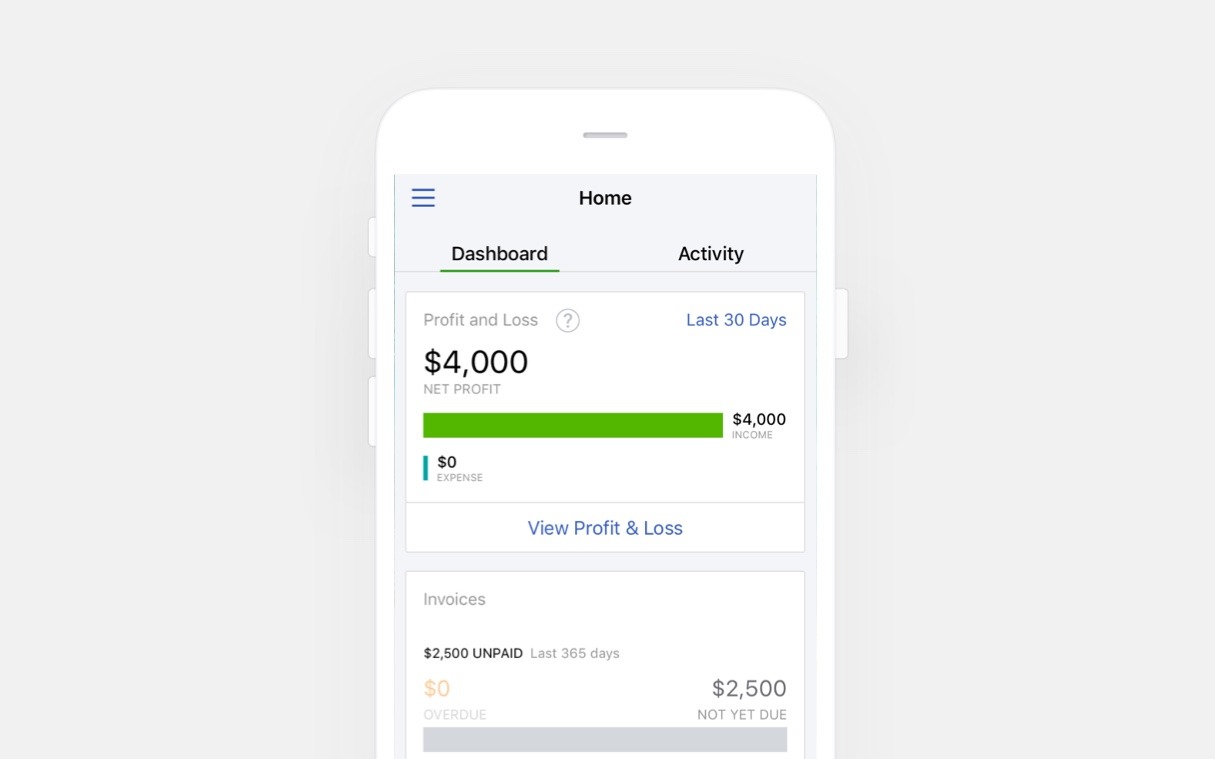

Mobile Friendly

Send invoices and monitor your business finances from anywhere using the QuickBooks mobile app.

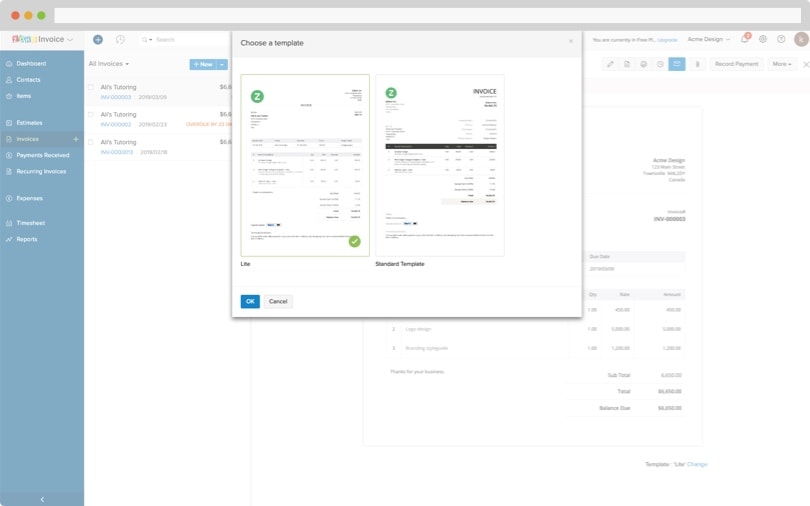

Get this templateZoho UK Freelance Invoice Template

Customize Invoices

Choose from a range of freelancer invoice templates and customize the design and layout to match your brand.

Get this template

Professional Invoice Design

Select your preferred template from a range of professional invoice designs for customized billing.

Get this template

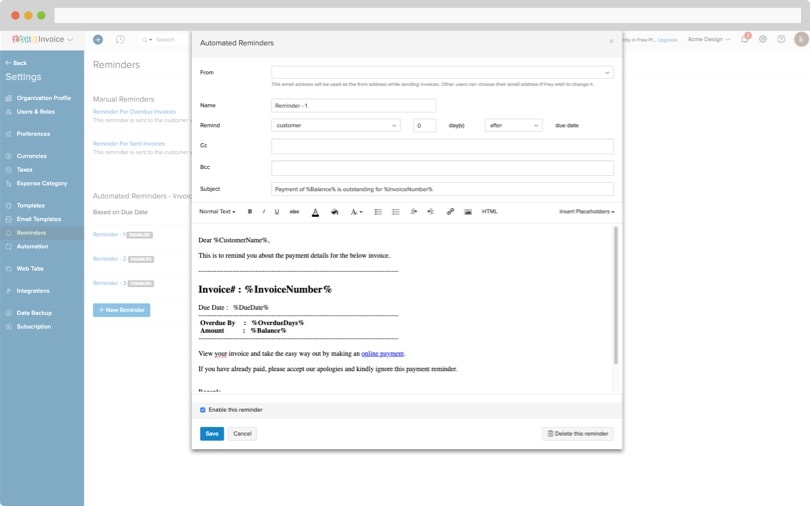

Automatically Send Payment Reminders

Send payment reminders automatically once invoices become past due. Use customizable email reminder templates to speed up the task.

Get this template

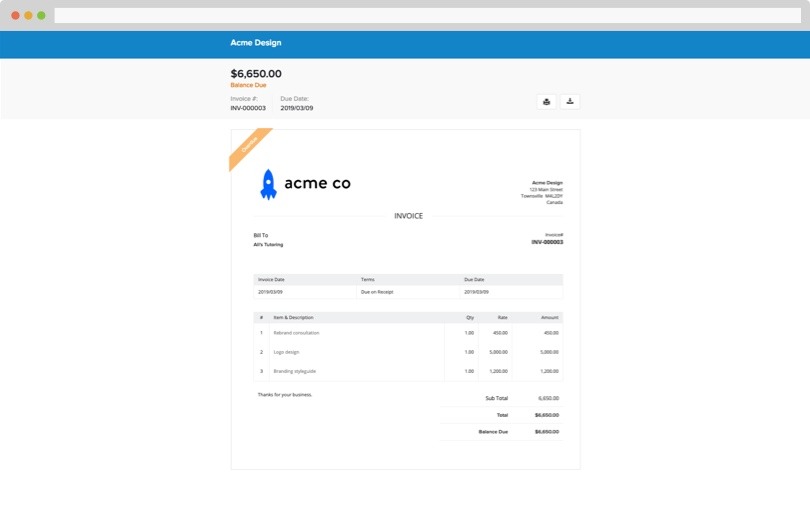

Client Can View Invoices Online

Clients view invoices and track their payments through the client portal.

Get this template

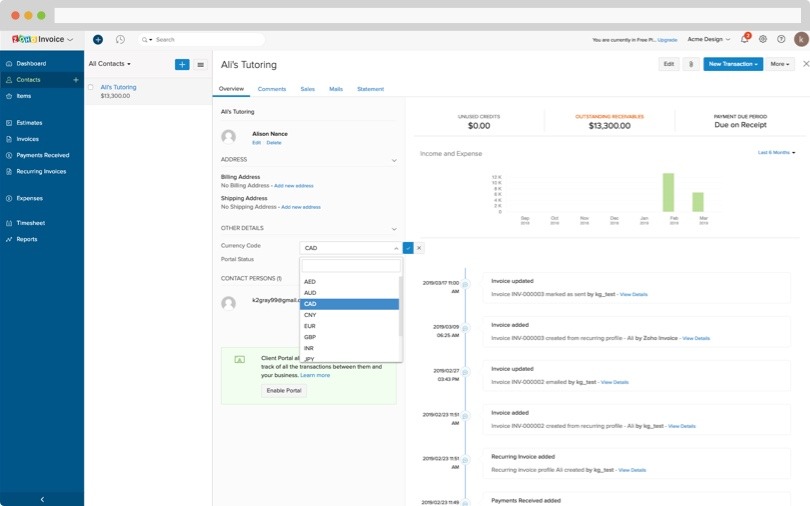

Adjust Invoice Language and Currency

Update the invoice currency in Settings and adjust language preferences through your Organization Profile.

Get this template

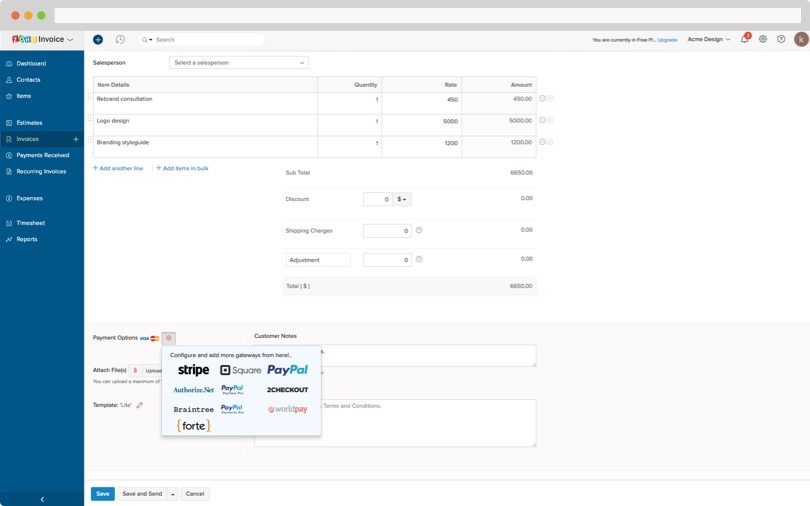

Accept Online Payments

Accept online payments by choosing a payment gateway from a range of providers including PayPal, Stripe and Square.

Get this template