We considered more than 30 accounting software solutions for freelancers and small business owners when deciding on our Top 5. What helped these five make the cut?

1. Setup and Ease of Use

As a small business owner, you’re likely to do more of your billing and accounting activities yourself. So it’s important to find accounting software you can pick up easily and actually enjoy (yes, we said enjoy!) using.

If you’ve been in business a long time, getting set up on a new solution will take longer. But all the accounting software we picked has a simple onboarding process and you can be fully set up and billing, tracking and managing reports within a few hours.

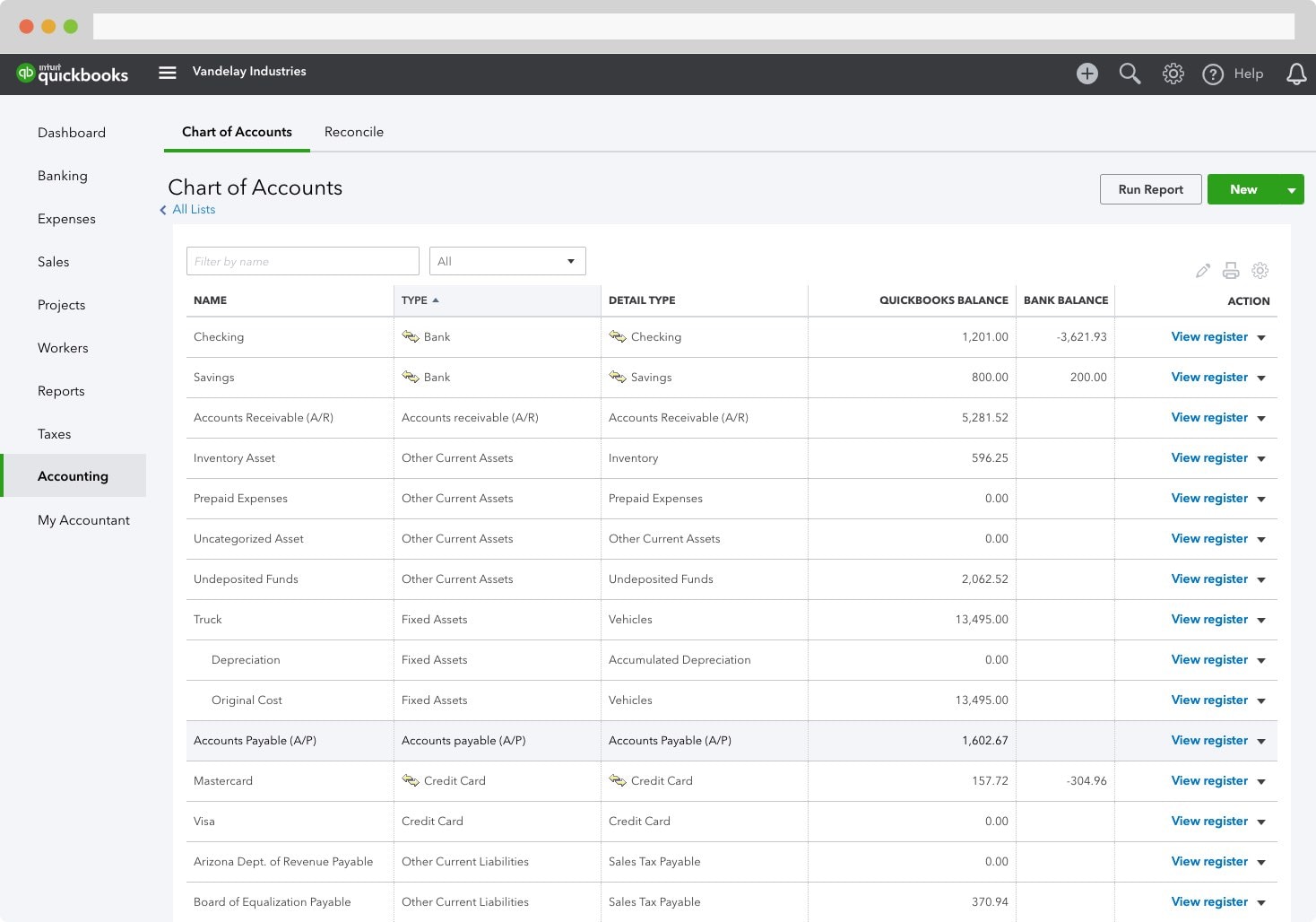

2. The Accounting Software Features You Need

Depending on the age and complexity of your business, you may need more advanced accounting features. These will become especially important if you plan to scale your business dramatically.

However, many small business owners (especially freelancers) prefer to make do with a simpler solution and let a bookkeeper or accountant manage the more advanced accounting tasks, like tax preparation etc.

Spend a few minutes getting crisp on your real needs and where you’re struggling today. We’ve selected solutions that span basic to advanced features.

3. Other Features that Offer Efficiencies

Some accounting software also multi-tasks to be a more general business solution. Some of the tasks they offer include:

- Estimates and proposals

- Contract management

- Project and client management

- Time tracking

If there are opportunities to find efficiencies with your broader software stack, take them!

4. Accounting Software that Will Scale with Your Business

It’s important to choose something that serves your small business right now. You don’t need to overpay for features you won’t use today.

However, most small business owners have grand ambitions. So we wanted to make sure the products we picked could scale with your business.

These solutions all offer tiered plans and you can graduate to the next plan level as your business grows. This means you won’t be overpaying for more complexity right now. But, if and when you need it, there are more features and functionality, integrations and add-ons to unlock.

5. Can You Use it On-the-Go

Our lives are increasingly mobile in every regard, so it made sense to focus on the accounting software with the best mobile apps.

In particular, billing and expense tracking are small tasks that can pile up if not handled promptly. So having a mobile app that allows you to handle these tasks on-the-go saves you time and helps your business stay healthy.

6. Outstanding Support

Support is easily overlooked when you’re choosing software. After all, most people would prefer to never need help from a Customer Support representative.

Still, if/when you need support, you want to know that you’ll get what you need. Tax and accounting are complex and important enough to know that you’ll want to ask questions.And should anything ever go wrong, it’s important to know your accounting software provider has your back.